Corporate TAX

The Ministry of Finance (MOF) has released high level details on the proposed UAE Corporate Tax (CT) regime in the form of a press release and Frequently Asked Questions (FAQs) published on web portal of tax authorities i.e. UAE MOF and the Federal Tax Authority (FTA). This is motivated by UAE’s desire to integrate into the global business community and meeting international tax standards, while minimizing compliance burden for UAE businesses and shielding small businesses and start-ups.

His Excellency Younis Haji Al Khoori, Undersecretary of MOF, stated that “the certainty of a competitive and best in class Corporate Tax regime, together with the UAE’s extensive double tax treaty network, will cement the UAE’s position as a world-leading hub for business and investment”. The relevant legislation for the CT regime (UAE CT Law) is currently being finalized and is expected to be promulgated during 2022. Once released, the UAE CT Law will provide details and guidance on several critical aspects.

UAE businesses will be subject to UAE Corporate Tax in a staggered manner from Financial Years (FYs) beginning on or after 1 June 2023. An entity having a FY beginning on 1 July 2023 and ending on 30 June 2024 will be subject to CIT from 1 July 2023. While, entities having a FY beginning on 1 January 2023 and ending on 31 December 2023, will be subject to UAE CT from 1 January 2024.

Scope

UAE CT is a federal tax and consequently, will apply to all businesses and commercial activities in the UAE except for extraction of natural resources which will continue to be taxed at the Emirate level. Likewise, the UAE CT regime will apply to individuals to the extent that they hold (or are legally required to hold) a business license or permit to carry out commercial, industrial and/or professional activities in UAE. This includes income earned by freelance professionals for activities carried out under a freelance license or permit.

Rates and Computation

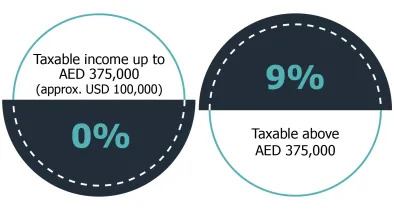

Adopting a slab rate system, the headline UAE CT rate has been fixed at 9% to be calculated on taxable income as below:

An increased UAE CT rate would be applicable for large multinationals that meet specific criteria set with reference to pillar two of the OECD BEPS 2.0. Taxable income for a tax year is to be computed based on accounting net profit/income of a business reported in financial statements prepared in accordance with internationally acceptable accounting standards, after the prescribed adjustments. With a 9% standard tax rate, UAE CT regime will remain one of the most competitive tax jurisdictions in the world.

Exemptions from UAE CT

As per the issued FAQs, certain incomes have been kept outside the ambit of the UAE CT including:

• Foreign investors will not be subject to UAE CT if income is not earned from a regular trade/business in UAE;

• UAE CT will not apply on capital gains and dividends received by a UAE business from ‘qualifying shareholdings’; and

• UAE CT will not be applicable to qualifying intragroup transactions and restructuring subject to certain conditions to be specified under the legislation.

It has also been announced that UAE CT will honour tax incentives committed to businesses located in Free Zones, to the extent that eligible entities comply with applicable regulatory requirements and do not conduct business in mainland UAE. Further, current business models for trade in goods and/or provision of services may need to be restructured once further guidance is released by MOF. Free Zone businesses will nevertheless have to comply with certain obligations under UAE CT regime, including the obligation to register and file a Corporate Tax return and claim exempt as applicable.

Other key noteworthy aspects from the announcement

The UAE CT regime will allow a business to utilize tax losses incurred (from the date UAE CT is effective) to offset taxable income in subsequent tax years. Based on current guidance, it seems that eligibility for tax losses would be applied on a prospective basis i.e. from the first tax year onwards. Further, a ‘Fiscal Unity’ concept would be implemented as part of UAE Corporate Income Tax (CIT) law i.e. eligible UAE group of companies may elect form a tax group and file a single (consolidated) tax return subject to conditions to be specified.

A tax withholding regime has not been included in proposed UAE CT law. In other words, there will be no withholding tax on domestic and cross border payments. This can be seen as a substantial relief to UAE business as introduction of a withholding tax regime increases compliance burden and other administrative complexities. Foreign Tax Credit (FTC) will be allowed against UAE CT liability. This is in line with corporate tax regimes followed by most of the countries across the globe.

UAE businesses will need to comply with international Transfer Pricing (TP) rules and documentation requirements contained in OECD TP Guidelines (as amended in 2022) for related party transactions. It would be interesting to see if domestic transfer pricing rules are introduced similar to other tax jurisdictions in the region.

Accounting considerations

As per the FAQs, accounting profits/income of a business (which is the starting point of a taxable income computation) should be as per internationally acceptable accounting standards. Hence, it will be obligatory for all businesses under UAE CT regime to maintain accounting records as per International Financial Reporting Standards or prevalent GAAP in UAE. It would be interesting to see whether UAE CT law mandate annual financial statements to be audited in the absence of a mandatory requirement under commercial law for a large section of businesses in the UAE.

Key takeaways and what business in UAE should do in the interim

The announcements and guidance released by UAE MOF has clarified key design features of UAE CT, however, several uncertainties remain awaiting clarity in UAE CT law and its implementing regulations. Whilst the announcement implicates that large multinational groups (MNEs) will be taxed at a higher rate, it remains to be seen how this will be implemented from a policy perspective (e.g., increase in tax rate or a domestic minimum tax/ parallel tax) which is yet to be announced.

Businesses operating in UAE should consider the following to get ready well in advance of the UAE CIT go-live date:

• Finance functions should begin preliminary assessment of existing business operations to identify broad areas which could pose challenges from UAE Corporate Tax perspective

• Discuss the issues identified with relevant departments and plan an approach/ methodology to be adopted for implementing UAE CT

• Identifying possibility to restructure business operations and optimize the current business structure to minimize the impact of the proposed UAE CT and envisaged TP regulations

• Perform gap analysis to identify required system changes to meet financial information requirements for UAE CT compliance.